Stay updated with the ICB fees cost and payments. This is a great way to plan your studies when you get started in our ICB Courses. Students who study face-to-face can pay their fees directly to their college. Distance learning students can securely make payments on the ICB student portal.

How Much Is ICB Registration Fees 2023?

The annual registration fee for 2023 is R430. This should be paid in January at the start of the academic year. It covers all administrative activities that are not directly related to your finals. It should only be paid once per academic year, regardless of when you start your ICB course.

ICB Exam Fees 2023

ICB exam fees 2023 cover all the costs that are related to your final exam. This includes the late fee to certificate reprint fees. These fees can be paid on the ICB student portal.

| Assessment fees for PoE | R785 |

| Assessment postponement fee per subject | R330 |

| Assessment late entry fee per subject | R560 |

| Assessment re-mark and examiners report fee | R1200 |

| Private invigilator admin fee | R2100 |

| ICB programme certificate reprint | R400 |

| FASSET certificate reprint | R400 |

| Workplace PoE assessment (Learnerships) | R1450 |

Recognition Of Prior Learning Fees 2023

If you have a relevant qualification or work experience, you can apply for recognition of prior learning (RPL). It gives you the chance to use your experience of qualification as credits to qualify for an exemption. This will help you get a headstart on your studies.

| RPL/Exemption application fee | R510 |

| RPL/Exemption fee per subject (no PoE required) | R430 |

| RPL/Exemption PoE fee per subject (with PoE) | R995 |

CPD and Webinar Replay Fees 2023

From live to replay, ICB offers CPD webinars to help you further your skills. Choose a webinar you would like to watch and then make a payment. ICB will send you a link on one of their platforms where you will be able to tune in to the webinar.

| Live webinar | R100 |

| Webinar reply fee | R75 |

How Do I Pay ICB?

Both classroom-based and distance learning students have their own method to make payments:

- Classroom-based students – You can pay your fees directly to your college or ICB training provider. They will then pay your fees to ICB on your behalf.

- Distance learning students – You can pay your fees directly on the ICB student portal or through EFT. All payments on the student portal are safe and secure.

ICB Banking Details

Distance learning students can pay their fees via:

- Debit or credit card

- Instant EFT

- EFT and bank payment

Debit Or Credit Card

Use your debit or credit card to make payments on the student portal. All payments are made through Payfast. This means your payments are secure and information protected.

Instant EFT

On the student portal, you can also make secure payments through instant EFT. For all payments, use your ICB reference number or South African ID number as the payment reference.

EFT And Bank Payment

You can also pay your fees through EFT and bank payments. The details you will need to make the payments are on your invoice.

Keep in mind: There are no cash payments or debit order payments available. If you have no other way to pay your fees, you can go to FNB to make a deposit. Once you are done, you must ICB your proof of payment.

How Do ICB Fees Work?

Your fees consist of your annual registration fee and assessment fees per subject. If you are writing more than one subject, you will need to pay an assessment fee for each module.

Does NSFAS Fund ICB Courses?

No, National Student Financial Aid Scheme (NSFAS) does not fund ICB courses. NSFAS only funds study programmes offered at public institutions. ICB courses are offered by private colleges and training providers.

How Do I Register With ICB?

Your studies with ICB start with creating a profile on the ICB student portal:

- Open an updated version of Google Chrome.

- Go to the ICB website.

- On the top of the page, go to ‘student login’.

- Click ‘register’.

- Complete the form and click ‘register’. This will take you to the learner registration page.

Add all your important personal information and details on the learner registration page by completing the five steps:

- Step 1: Learner information

- Step 2: Contact details

- Step 3: Learner specifics

- Step 4: Demographic

- Step 5: Confirmation

ICB Student Portal

When you study ICB courses via distance learning with us, you can complete all administrative activities on the ICB student portal:

- Register as a new ICB student.

- Book your ICB exams.

- Download and print exam confirmations in PDF.

- View your assignments, tests and final exam results.

- Update your personal information.

- Make safe and secure payments.

ICB Exam Booking

You can use the easy-to-follow steps below to help you book your ICB final exam:

- Go to the student portal.

- Click ‘enter assessments’ on the left side of the screen.

- Choose a subject you want to write from the drop-down menu.

- Select a venue from the drop-down menu.

- Pick an available assessment date for the exam.

- Add all the items you selected to the ‘basket’.

- Review everything in the basket to make sure the right items were selected.

- Check the billing address to make sure it is correct.

- Checkout and submit all the details.

- Make a payment.

After making the exam booking, you will then have access to your ICB digital portfolio of evidence (PoE).

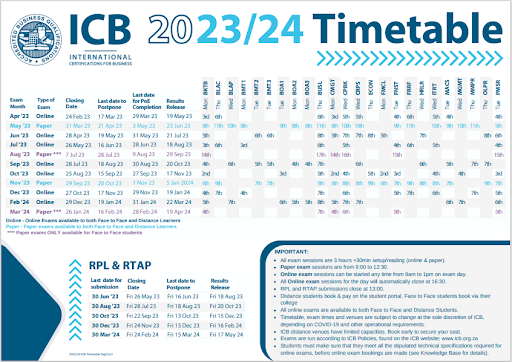

ICB Timetable

The ICB exam timetable has all the exam information and important dates you need related to your finals. On the ICB timetable 2023/24, you will find:

- The month you will write your finals.

- Type of exam you will write – paper or online exam.

- Due date to book an exam for that month.

- Last date to postpone your exam to the next available date.

- ICB PoE completion deadline.

- Release date for ICB final exam results.

Download a Brochure

Complete the form below and we will contact you as soon as possible.

Get a Call Back

Complete the form below and we will contact you as soon as possible.

ICB Courses

There are three internationally accredited ICB courses you can study with us via distance learning:

Accounting Courses

Start your career as a financial manager or accountant with our Accounting Courses.

- Junior Bookkeeping Course

- Senior Bookkeeper Course

- Technical Financial Accounting Course

- Certified Financial Accounting Course

Business Management Courses

Learn quality skills that will help you turn a small business into an international empire with our Business Management Courses.

- Small Business Financial Management Course

- Office Admin Business Management Course

- Business Management Financial Accounting Course

Office Administration Courses

Our Office Administration Courses are a great way to learn practical workplace skills to help take the first step into the job market.

- Junior Office Administration Course

- Higher Certificate Office Administration Course

- Office Administration Diploma Course

What Are ICB Entry Requirements?

You must be able to read, write and understand English to study our ICB Courses since all your coursework will be given in this language. You will also need to meet the following requirements to study ICB with us:

| Course | Entry Requirement |

| Accounting Courses | Grade 10 |

| Business Management Courses | Grade 11 |

| Office Administration Courses | Matric certificate or equivalent |

Are ICB Courses Accredited?

Yes, all ICB courses are accredited. The Quality Council For Trades & Occupations (QCTO) accredits ICB courses. This ensures that you meet quality standards set by the National Qualifications Framework (NQF).

Is ICB A Recognised Qualification?

Yes, ICB qualifications are recognised in South Africa and in countries across the globe. If you have always wanted to work abroad, this qualification will allow you to find a job overseas as a finance professional. Make sure you have work experience, and all the correct documents before your qualifications take you around the world.

ICB Qualifications Equivalent

ICB qualifications are all equal to a National Qualifications Framework (NQF) level. These qualifications are registered on the South African Qualifications Authority (SAQA) and have SAQA ID numbers.

Accounting Courses

ICB accounting courses start at NQF Level 3. Complete all four levels, and you will achieve your national diploma.

| Course | NQF Level |

| Junior Bookkeeping Course | Level 3 |

| Senior Bookkeeping Course | Level 4 |

| Technical Financial Accounting Course | Level 5 |

| Certified Financial Accounting Course | Level 6 |

Business Management Courses

ICB business management courses range between NQF L4-6. Complete all three levels, and you will also be able to achieve your national diploma.

| Course | NQF Level |

| Small Business Financial Management Course | Level 4 |

| Office Admin Business Management Course | Level 5 |

| Business Management Financial Accounting Course | Level 6 |

Office Administration Courses

There are two NQF L5 ICB office administration courses you can study with us. Get your accredited diploma when you complete all three courses.

| Course | NQF Level |

| Junior Office Administration Course | Level 5 |

| Higher Certificate Office Administration Course | Level 5 |

| Office Administration Diploma Course | Level 6 |

Does Unisa Accept ICB Qualifications?

No, Unisa does not immediately accept ICB qualifications. But you might be able to use your qualification or work experience to further your studies with us.

Keep in mind: Your work experience or ICB qualification must be relevant to the course you want to pursue.

Skills Academy is the word support in every way.

Frequently Asked Questions

No, you cannot study directly through ICB since ICB is not a college. They are assessment providers who test you on your business and finance skills. To study ICB courses, you must enrol with an accredited ICB training provider.

An ICB training provider is an institution registered with the Department of Higher Education and Training (DHET). There are over 500 providers across South Africa offering both classroom and distance learning. With a provider, you will get support and updated study material.

To pass your ICB course, you must get at least 50% in your finals, and at least 60% as an overall mark. There is no pass mark for your ICB digital portfolio of evidence (PoE). But you must pass all your test and assignments to be competent in your skills.

After graduating with your ICB qualification, you can pursue the following opportunities with your certificate:

- Get a job

- Start your own business

- Join a professional body

- Study further

Get A Job

Enter the job market and start a successful business with your ICB qualification. Use your skills and knowledge to enter the job market and take the first step towards your dream career.

Start Your Own Business

Be your own boss when you use your ICB qualification to start a small business. With your skills, you can turn your passion into a profitable business.

Join A Professional Body

When you have your Financial Accounting National Diploma NQF L6 qualification, you can enter a professional body. This will help you further your skills and career, and network with professionals.

Study Further

After completing the first level of your ICB stream, you can complete the advanced levels too. This will help you get your higher certificate. Once you complete all the levels, you will achieve your national diploma.

Now that you know what the cost of your course fees are, take a look at how to fund your ICB course:

- Get a student loan

- Apply for a private bursary

- Start a side business

- Work and study at the same time

Get A Student Loan

You can go to a South African bank and get a student loan. This will help pay for your tuition. Since it is a loan, you must pay back the money. The bank will inform you as to when you will need to start paying back the loan. But this is usually after your studies.

Apply For A Private Bursary

Since ICB courses are studied at private institutions, you can apply for a private bursary. Some bursaries will pay for your full tuition as well as additional costs such as travelling or accommodation. Other bursaries only pay a portion of your study fees.

Start A Side Business

Make an additional income by starting a side business. You can use this income to pay for your study material or make monthly deposits to pay for your fees.

Work And Study At The Same Time

When you study ICB courses via distance learning, it gives you the opportunity to study part-time and have a full-time job. You will be able to pay for your studies and gain work experience to further your career.