2021 brings new changes to the ICB and their courses! You can read all about it in their new brochure available to download right here. Also find the 2021 fees list and exam timetable. Make sure you have all the information you need to prepare well.

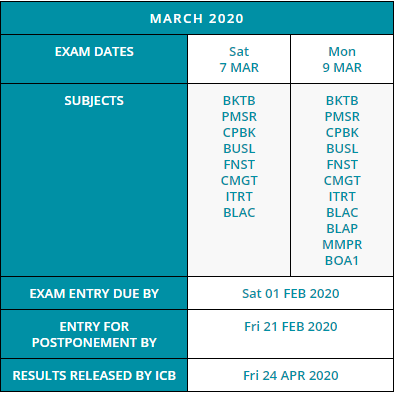

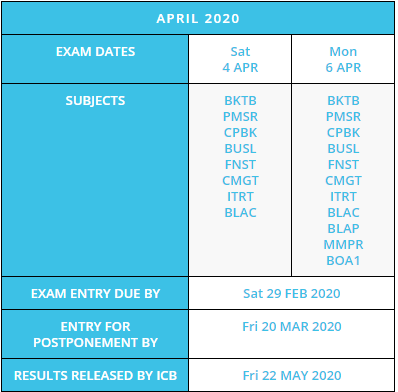

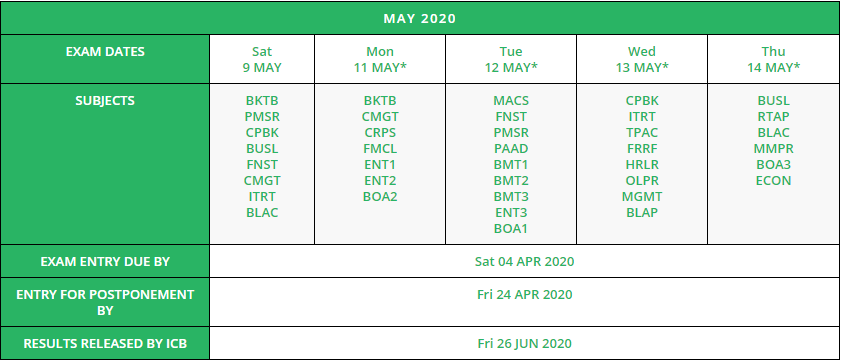

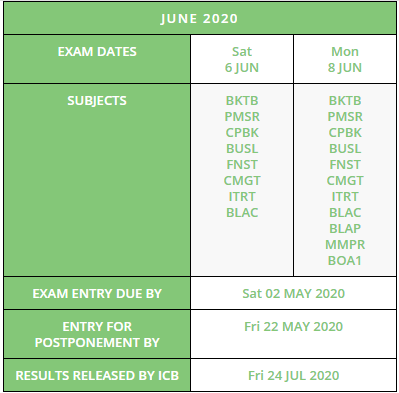

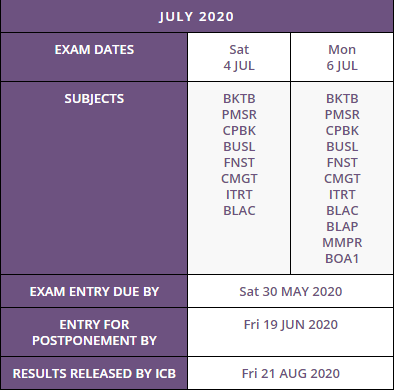

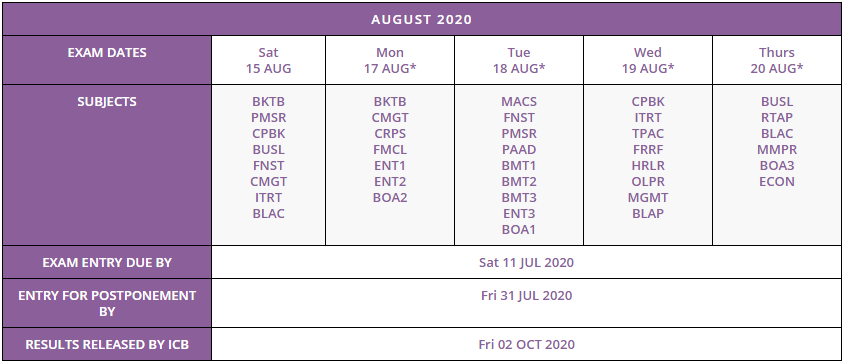

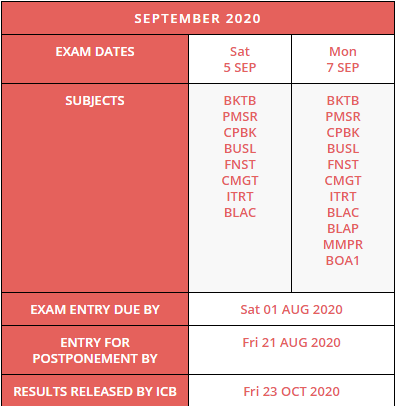

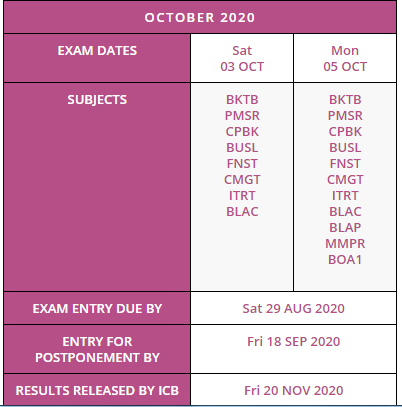

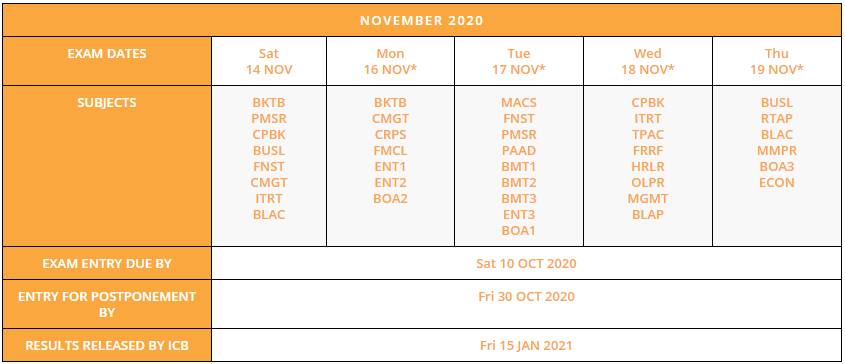

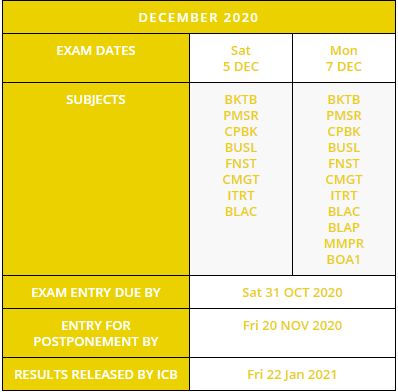

ICB 2020 Exam Dates – There are monthly opportunities for Classroom Learners to write the exams, but that’s not the case for our Distance Learning Students. Our Distance Learners have four opportunities to write the exams and they may occupy a seat in the February, May, August or November exams.

Distance Learning students may use the stars as a reference for the exam dates, and the rest applies to Classroom Learners.

The ICB Exam Dates 2020 are ready to download. All you have to do is to click on each image, and save it on a device of your choice. Once you’ve saved the timetable, you may print it out and use it at your disposal. You may also mark these dates on your calendar, or set reminders on your mobile device.

What are you waiting for? Save those dates and start with your exam preparation now!

CODE

SUBJECT

BKTB

Bookkeeping to Trial Balance

PMSR

Payroll and Monthly SARS Returns

CPBK

Computerised Bookkeeping

BUSL

Business Literacy

FNST

Financial Statements

CMGT

Cost and Management Accounting

ITRT

Income Tax Returns

BLAC

Business Law and Accounting Control

CRPS

Corporate Strategy

MACS

Management Accounting Control Systems

FRRF

Financial Reporting and Reg Frameworks

RTAP

Research Theory and Practice

MMPR

Marketing Management and Public Relations

CODE

SUBJECT

BLAP

Business Law and Administrative Practice

HRLR

HR Management and Labour Relations

ECON

Economics

BOA3

Business & Office Administration 3

MGMT

Public Accounting Administration

TPAC

Technical Public Accounting

OLPR

Office and Legal Practice

BMT1

Business Management 1

BMT2

Business Management 2

BMT3

Business Management 3

FMCL

Financial Management and Control

ENT1

Entrepreneurship 1

ENT2

Entrepreneurship 2

ENT3

Entrepreneurship